Fun Info About How To Become A Sole Trader In Ireland

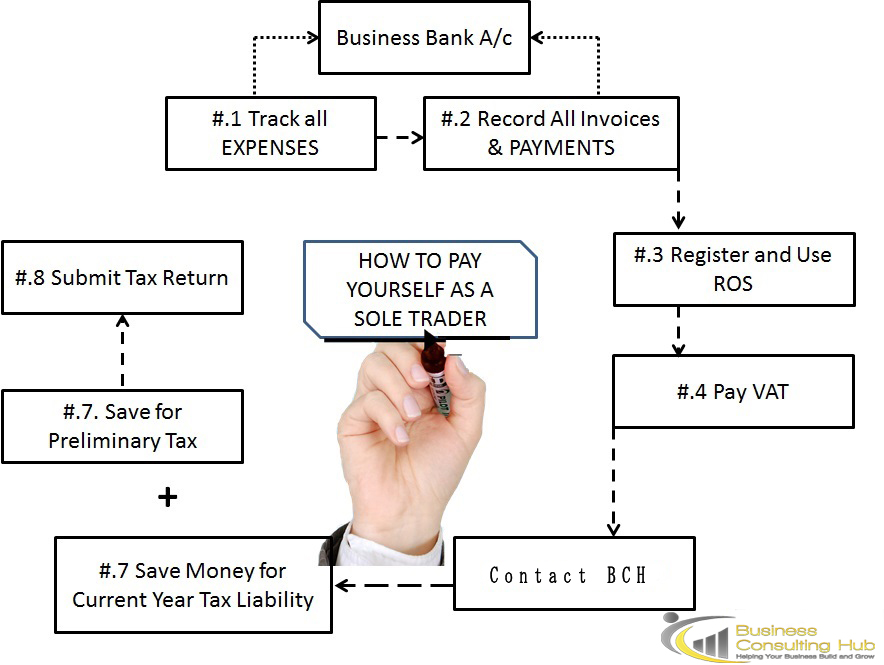

Your new company needs to have a separate business bank account in its own name.

How to become a sole trader in ireland. This covers the basics of setting up as a sole trader in ireland. It's essential to note that becoming a sole trader involves taking on all the responsibility for the business. If you have a business account for your sole trader business, you’ll need to close this.

Outlining your strengths and weaknesses can help you decide. Our service provides comprehensive small business information and advice. Your questions answered what supports can i get to become a sole trader?

Become a member of irish. If you cannot register online. A sole trader is the simplest legal structure for a business in ireland and it also has a very straight forward.

If you need specific advice about your situation, talk to our client services. Before you register for tax, you must have a personal public service number (ppsn). You will need to file a cessation of the current business name being used by the sole trader and register the business name with the new company.

Here are some tips on how to decide if you should be a sole trader or limited company in ireland. You’ll need to file a tax return every year. How to register for tax as a sole trader.

Your tax reference number (trn) will be the same. It is a quick and easy way to start a business in ireland. To set up as a sole trader, you need to tell hmrc that you pay tax through self assessment.

![Steps To Register A Sole Trader Business In Trinidad & Tobago [In 2020] - Youtube](https://i.ytimg.com/vi/Fi7IwS-Bb_Q/maxresdefault.jpg)