Build A Info About How To Build Credit As A Student

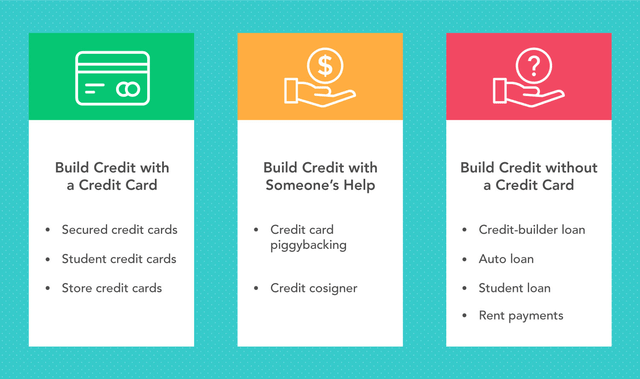

A secured credit card can be a great way for someone to begin building credit.

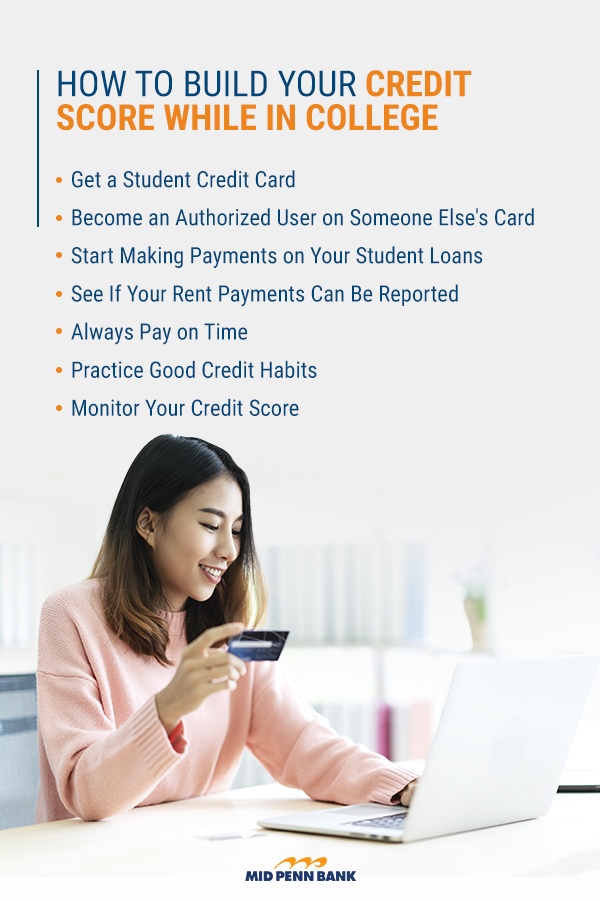

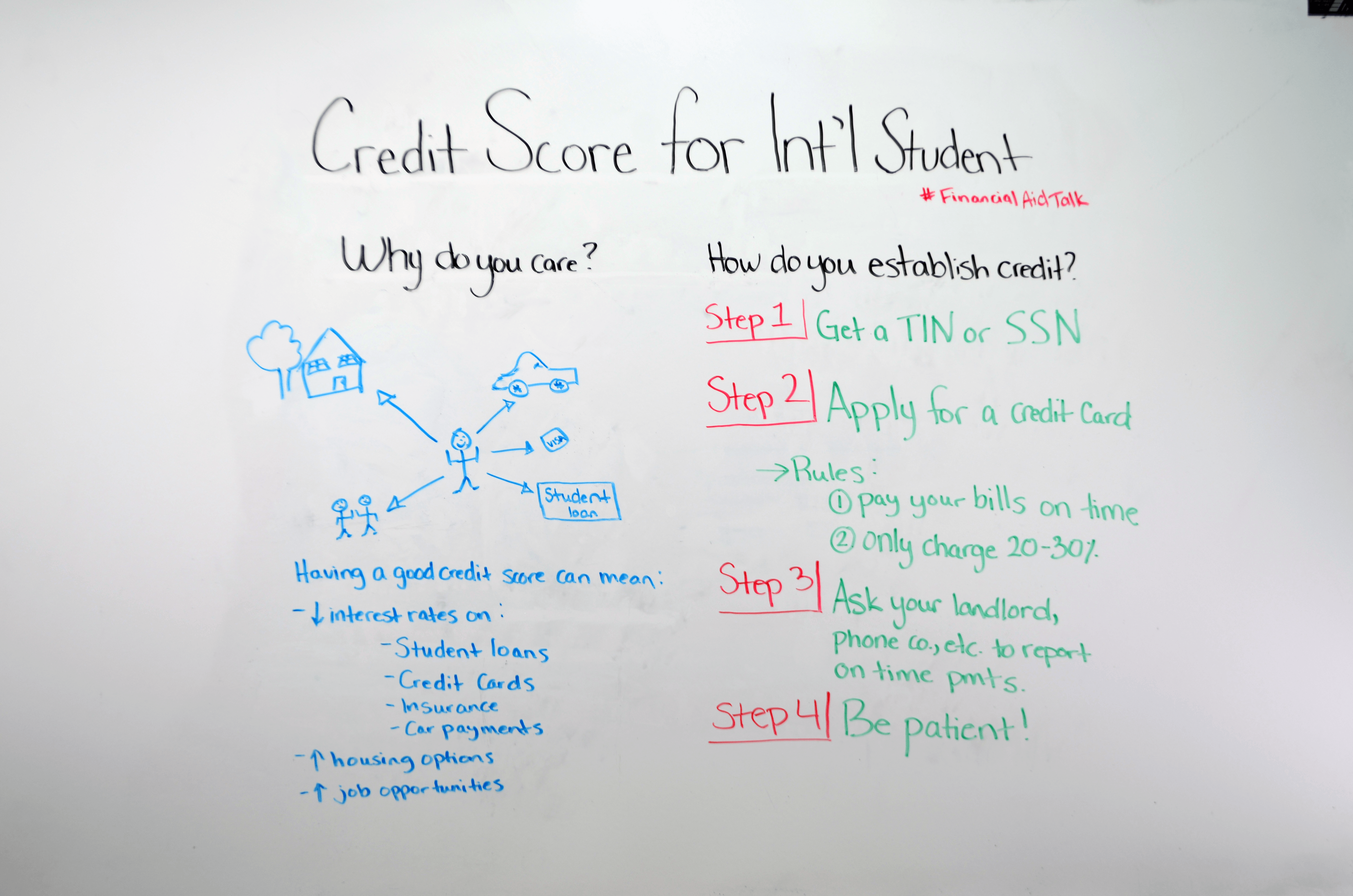

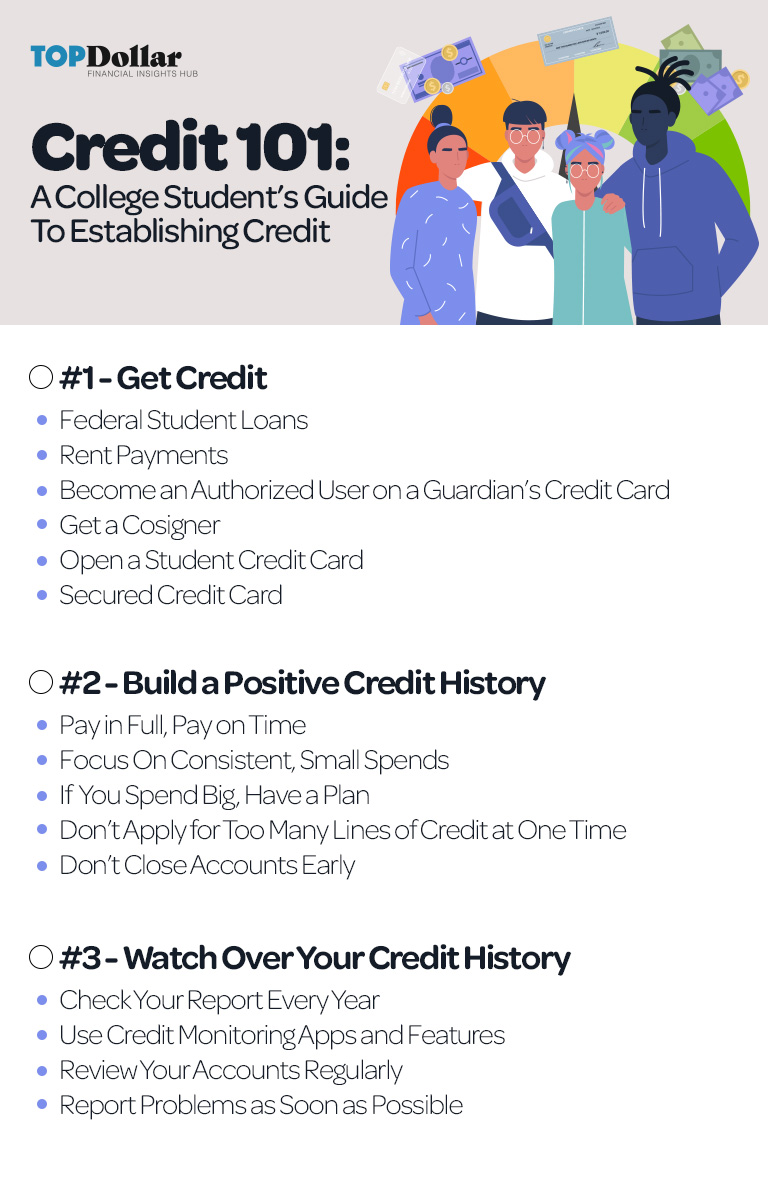

How to build credit as a student. While building credit takes time, college students can start establishing credit with just a few simple steps. Many credit card issuers offer student credit cards aimed at meeting the needs of college students. Using a secured credit card allows you to build your credit score (assuming you make timely payments) without the risk of going into credit card debt.

But in the wake of the credit card act, it may now be the only choice for. A credit builder loan is a great option to build credit as a student because you don’t need to have any credit history to qualify. Typically, student credit cards come with a low spending limit.

First, when you pay your full statement balance by the due date on your account, you can avoid paying expensive interest charges. Get a student credit card. Ad earn $100 by spending $100 on purchases in your first 3 months with select student cards.

Get more control over your financial life. Great rates & zero fees. If you need financial aid to complete your undergraduate degree, you may.

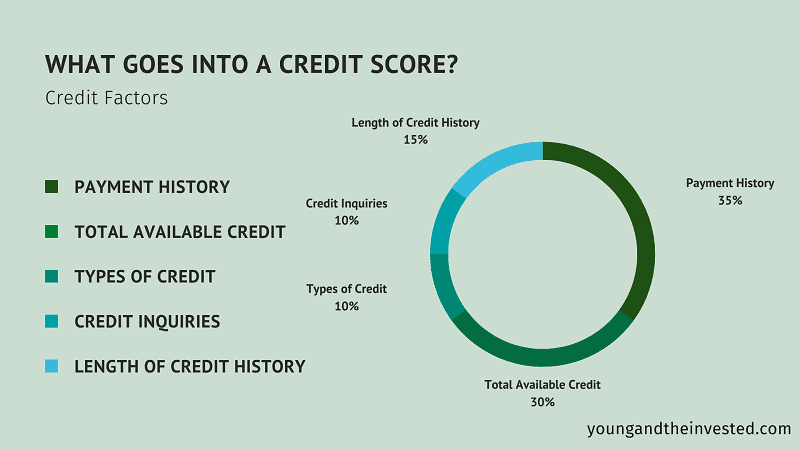

Ad help cover college costs, and get a student loan without the fees. The average interest rate is 16.17% (based on. All major credit card companies report information about student credit card accounts to credit bureaus,.

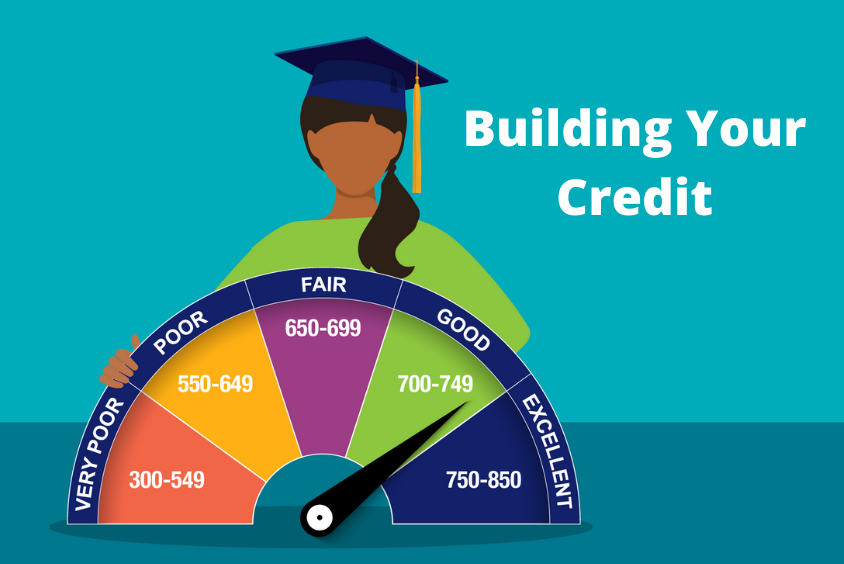

After many young consumers got into financial trouble with easy credit,. Despite the bad reputation that credit sometimes has, the ability to utilize credit in your personal finances is a necessity for many individuals. There are several ways to build credit as a college student, even if you are starting with zero existing credit.