Outrageous Tips About How To Lower Your Debt

Avoid bankruptcy and revive your credit!

How to lower your debt. Combining your debt and paying it off with a debt consolidation loan can give you a lower monthly payment. Choose from multiple options so you can build the future you want. Ad want to get out of debt?

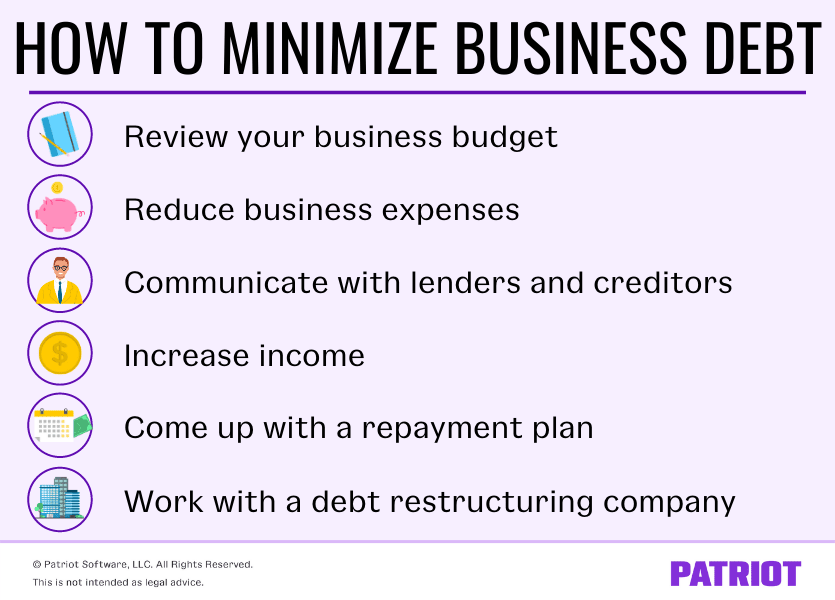

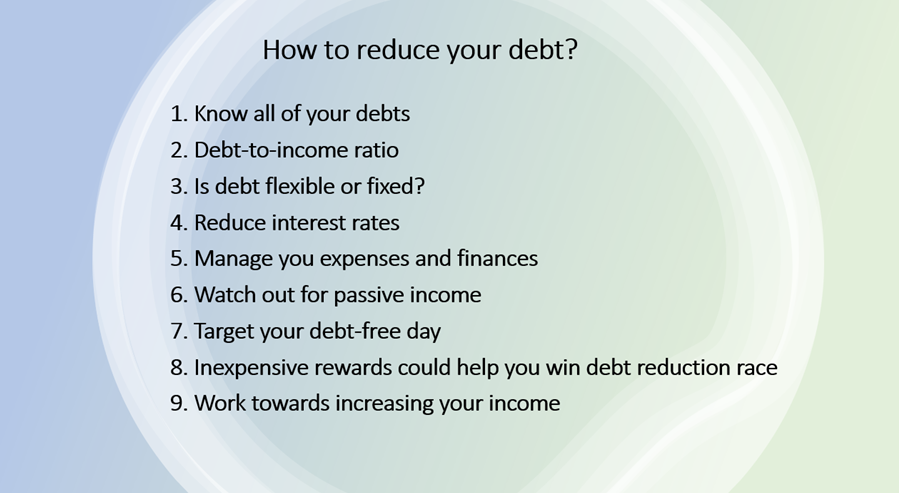

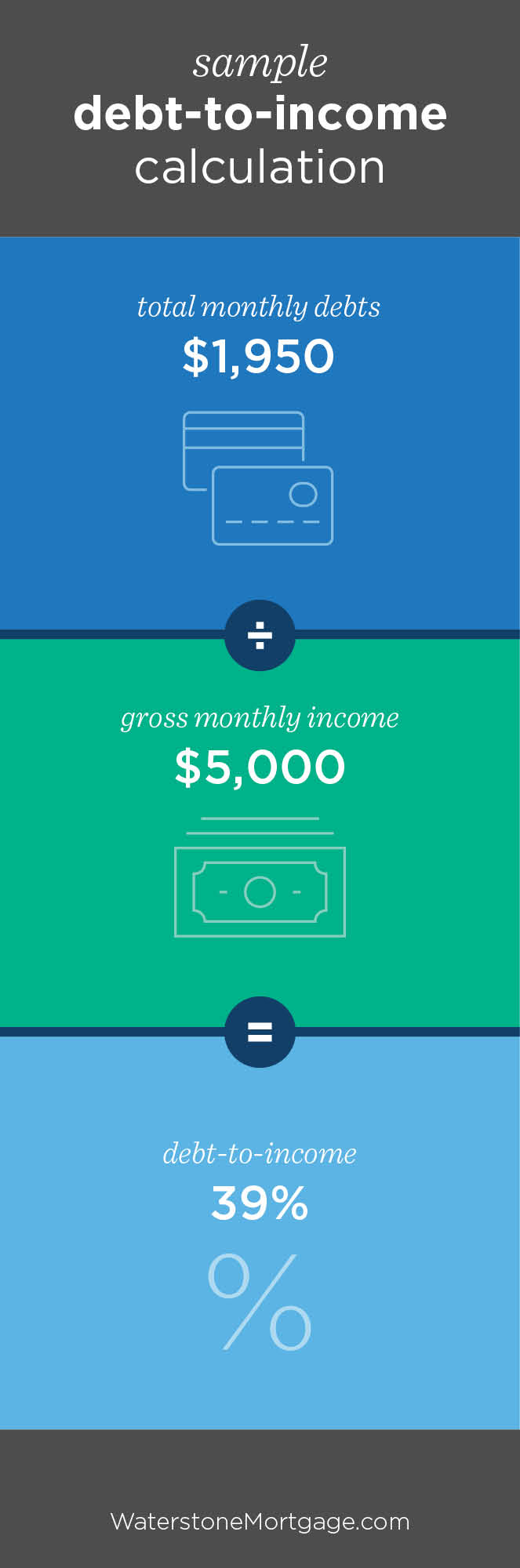

Lowering your debt 1 write down what you owe. Reducing the credit card balance will also reduce your monthly payment and your dti. Get started in 5 mins.

The first is to call the lender and ask for a reduction in the rate. The best thing to do is to talk to a lender and if your dti is high, work on lowering it. If your score was 600, though, and you only qualified for a 6.25%.

Next, begin paying down your existing balances by. If there's money left over after your monthly bills are paid, use it to pay down your current debt. Ad nerdwallet reviewed refinance lenders to help you find the right one for you.

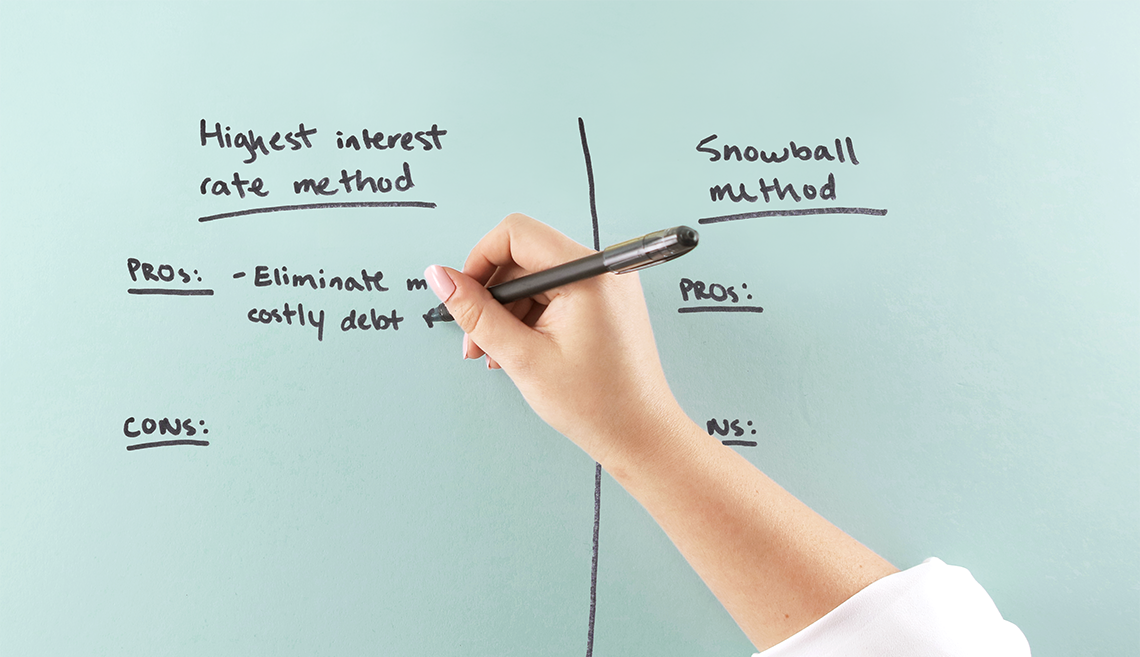

If you don’t qualify for a 0% apr offer, call your credit card provider and ask them to lower. Ad explore debt relief benefits with accredited debt relief. Find a payment strategy or two if you really want to tackle your credit card debt, consider these methods to get you to your goal.

Ad learn more about our debt resolution program today. With the snowball method, you pay off your debts from the smallest amount to the largest one. That could mean working some overtime, asking for a salary increase,.

_1.jpg?ext=.jpg)

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)